Elix is an Ethereum-based platform for payments, loans, and crowdfunding. The team is uniquely taking a mobile-first approach and focusing on usability to attract as large of a user base as possible from the start.

Market Problem: Keeping financial and personal information on a centralized server has proven time and time again to be an insecure means of data storage (e.g. Equifax). Not only does this expose sensitive data to hackers with a single point of failure, but it opens up the opportunity for fraud as well. With a single entity controlling data and transactions, who’s to say they aren’t manipulating data as the intermediary?

In this Elix beginner’s guide, we’ll cover how the project is solving these issues alongside everything else you need to know, including:

- How does Elix work?

- Elix team & progress

- Trading

- Where to buy ELIX

- Where to store ELIX

- Conclusion

- Additional Elix resources

How does Elix work?

The Elix network contains three separate components:

- Payments ledger

- Crowdfunding platform

- Peer-to-peer lending

Payments Ledger

The payments ledger is the foundation of Elix. This is where you send, borrow, and request funds as well as track any transactions that you’ve made. You have the choice of linking your ledger account to a local address on your phone or directly to the Elix app. Additionally, you have the ability to send “quick payments” to contacts without having to type in their address when you sync them to the app.

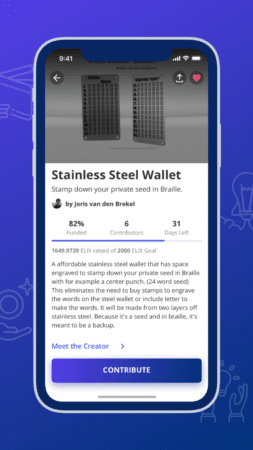

Crowdfunding Platform (Boost)

Elix also includes a platform, Boost, to facilitate decentralized crowdfunding campaigns using smart contracts. To contribute to a project’s campaign, you need to use the Elixir token, which the team has aptly named ELIX. Elix takes a percentage of the funds that projects raise through Boost but haven’t specified in ITS white paper what that percentage is yet. Additionally, the Elix team is vetting every project interested in raising funds on the platform to ensure that only quality projects are doing so.

Peer-to-Peer (P2P) Lending

Lastly, Elix is offering an incentivized, peer-to-peer (P2P) lending program.

In a traditional loan, the borrower pays back the lender in a series of installments over time. These installments include the interest rate that the loan terms spell out. In this system, there aren’t many incentives for the borrower to pay the installments on time except for the risk of being sent to collections.

With Elix, though, both the lender and the borrower are incentivized to follow the terms of the loan. When setting up a loan, the participants can opt to include a mining period once the loan is complete to gain additional rewards. If enabled, as a lender, you must hold the ELIX in your wallet for a certain amount of time in a system similar to Proof-of-Stake. When that holding period is complete, Elix hands out the rewards in the form of a new token, Token P. This token will most likely have a different name in the future.

If the borrower pays back the loan on time, the reward is split with the lender receiving 65% and the borrower receiving 35%. If the borrower has late payments, though, the lender receives 100% of the reward.

Token P will have a fixed maximum supply that the team only expects to reach after a few decades.

Proof-of-Time Mining

Uniquely, Elix uses proof-of-time to mine ELIX. This is a fairly complex mining strategy, so we’re going to break it down step-by-step:

- As an initial user, you create a parent and child Ethereum address. This occurred during the genesis of Elix.

- The Elix team airdrops 1 Elixor (EXOR) into your child address.

- At any time, you can move you 1 EXOR from the child to the parent address. You’re able to do this 10 times with each child-parent pair.

- When you move the EXOR from child to parent, you receive a certain number of ELIX in its place. This number starts at 2500 but increases to 5000 over the next 10 years.

- Therefore, the longer you hold your EXOR, the more ELIX you’ll receive when you finally transfer it.

Because of the varied mining rewards, it’s tough to predict what the total supply will be once mining is complete.

[thrive_leads id=’5219′]

Elix team & progress

The Elix team consisted of two co-founders, David Jackson and Melanie Plaza, for quite some time but has recently expanded, adding an advisor and a front-end developer.

The team is young in comparison to other blockchain teams. Jackson graduated from Stanford with a degree in Mechanical Engineering in 2017 and began working on Elix immediately after. Although still new to blockchain, Plaza has previous start-up experience as the CTO of To The Tens and co-founder of Crunchbutton.

This limited experience hasn’t seemed to impede their progress, though. Since the platform’s inception in September 2017, the team has released a beta for the payments ledger and have opened up the crowdfunding and lending smart contracts for testing.

ETHLend is probably Elix’s biggest competitor in the P2P lending space. ETHLend supports a wider variety of cryptocurrencies that you can loan but is missing the loan rewards program that Elix offers.

As a payments platform, Elix is competing with Request Network and OmiseGo among a few other projects. Because Elix is primarily a loan and crowdfunding platform, its payment options are much simpler than what its competitors offer.

Trading

The ELIX price has spiked two times since it first began trading in September 2017. The first rise (and subsequent fall) occurred at the beginning of October 2017. Although you can never be certain, this appears to have been at least partially caused by a popular Youtube crypto influencer, Suppoman, who posted a video at that time stating that ELIX was a good project to invest in.

The next significant price movement was at the end of 2017 and beginning of 2018 as ELIX rose and fell with the entire cryptocurrency market. The price has been fairly steady ever since, currently at about $0.42 (~0.00005 BTC).

The public release scheduled for the end of Q2 2018 should have a positive impact on the price. However, if it doesn’t live up to investors’ expectations, it could be detrimental in the short-term (and possibly even the long-term) future.

Where to buy ELIX

KuCoin offers ELIX as a trading pair with BTC and ETH. If you don’t own either of those two coins, check out our guides on how to buy Bitcoin or how to buy Ethereum first.

Where to store ELIX

ELIX is an ERC20 token, so any wallet that supports Ethereum-based tokens should work. MyEtherWallet is a popular online choice among investors. For more security, though, consider using a hardware wallet like the Trezor or Ledger Nano S.

Once the team releases the mobile app to the public, you should ideally store your ELIX using that wallet.

Conclusion

Elix is aiming to decentralize peer-to-peer lending, crowdfunding, and normal payments. Although currently a team of just four, they’ve made substantial progress so far. They’ve built a beta for payments and finished the smart contract development for its lending and crowdfunding platforms.

With no leader in the space, yet, Elix’s lean operations could propel them to the top. However, a multi-million dollar initial coin offering (ICO) from a competitor may make that easier said than done.

Additional Elix resources

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.